With the rise of remote work as a staple in modern employment, accountants and taxpayers alike find themselves facing new challenges. As businesses and employees embrace remote work, understanding the tax implications becomes essential.

The pandemic catalyzed a shift toward telecommuting, and now, many companies have permanently adopted hybrid or fully remote models. This evolution carries significant tax implications that must be recognized by businesses and their accounting partners.

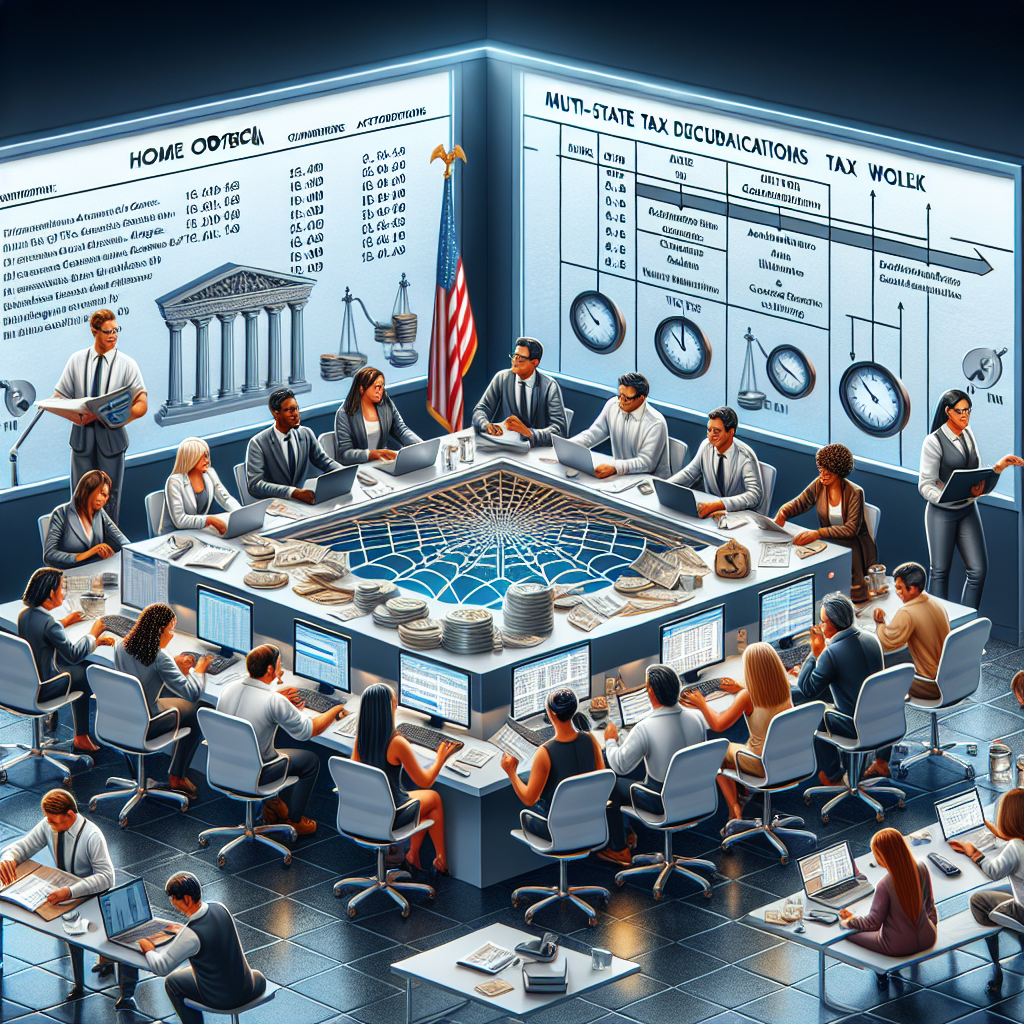

One critical area of concern is the impact on state income taxes. When employees work across state lines, it can create a complex web of multi-state tax liabilities. Companies must ensure compliance with varying state regulations, leading to an increased demand for services from tax professionals adept at navigating these intricacies.

Moreover, the potential for double taxation is a real threat. States with reciprocal agreements alleviate some issues, but those without these agreements require employees and employers to remain vigilant. Accountants must work closely with clients to ensure they are aware of these obligations and devise solutions that cater to their specific situations.

Another significant consideration is home office deductions. The change in work environment allows eligible taxpayers to claim deductions for office space expenses. However, qualification criteria and the type of deductions possible can be complex. The pandemic has paved the way for increased scrutiny by tax authorities, with detailed documentation and validation expected.

Accounting professionals must emphasize proactive tax planning strategies for their clients, enabling them to seize opportunities for tax savings while remaining compliant. They should also proactively communicate the evolving changes in tax regulations to help clients adapt smoothly to this new standard.

Firms can turn these challenges into opportunities by investing in training and technology that aids in understanding multi-state taxation, digital documentation, and compliance tools. By doing so, they enhance their value proposition as trusted advisors in these unprecedented times.

Historically, firms that embraced change and leveraged knowledge-sharing platforms adapted swiftly to the financial crisis in the late 2000s. Today, similar adaptability is required as the taxation landscape evolves.

For example, Ernst & Young recently launched an initiative to provide specialized consultancy services for companies transitioning to remote work. This proactive approach, showcasing agility and foresight, serves as an example for others in the industry to follow.

In an ever-changing business environment, adaptability and informed decision-making hold the key to unlocking success. Navigating the tax implications of remote work presents unique challenges and opportunities for accounting professionals. By staying informed and adaptable, accountants can effectively guide their clients through this evolving landscape.

Estimated reading time: 2 minutes, 14 seconds

Tax Implications of Remote Work: Navigating the Shifting Landscape Featured

Explore the tax implications of remote work and the essential considerations for accounting professionals. Learn how state income taxes, home office deductions, and proactive tax planning evolve with the remote work trend.

Explore the tax implications of remote work and the essential considerations for accounting professionals. Learn how state income taxes, home office deductions, and proactive tax planning evolve with the remote work trend.

Latest from The Progressive Accountant

- Noteworthy Leadership Shifts in Top Accounting Firms This Week

- The Latest Trends in Tax Compliance for Accountants

- Leveraging Emerging Technologies for Scaling Your Accounting Firm

- Navigating the Latest Tax Reforms: What Accountants Need to Know

- Navigating the Changing Landscape of Sales Tax Compliance

Most Read

-

-

May 05 2025

-

Written by The Progressive Accountant

-

-

-

Jun 15 2025

-

Written by The Progressive Accountant

-

-

-

Jun 29 2025

-

Written by The Progressive Accountant

-

-

-

Jun 15 2025

-

Written by The Progressive Accountant

-